VARBX (CLASS I SHARES) VARAX (CLASS A SHARES) VARCX (CLASS C SHARES)

NAV

$ 10.82

Daily Return - Daily

0.09%

YTD Return

1.79%

As of previous day’s close for VARBX. The NAV is for subscriptions only and not for redemptions.

Fund Objectives

The First Trust Merger Arbitrage Fund seeks returns that are largely uncorrelated to the returns of the general stock market, and capital appreciation.

The strategy seeks to take advantage of the return opportunity presented by the natural deal spread that emerges after the announcement of companies undergoing a merger or acquisition. Merger arbitrage is an event-driven strategy whose risk and return profiles is not dependent on the direction of the overall stock market. There can be no assurance that the Fund’s objectives will be achieved.

The Fund aims to provide:

Low Correlation to Stock & Bond Markets

- Merger arbitrage is an alternative investment strategy that strives to take advantage of price discrepancies that exist for companies involved in a merger. If successful, a merger arbitrage strategy can benefit by purchasing companies at prices below the target price and locking in the differential (arbitrage spread). Targeting this spread seeks to deliver returns that we believe are largely insulated from fluctuations in the broader market.

- Merger arbitrage has historically produced persistent absolute returns with no correlation to traditional stock and bond exposures.

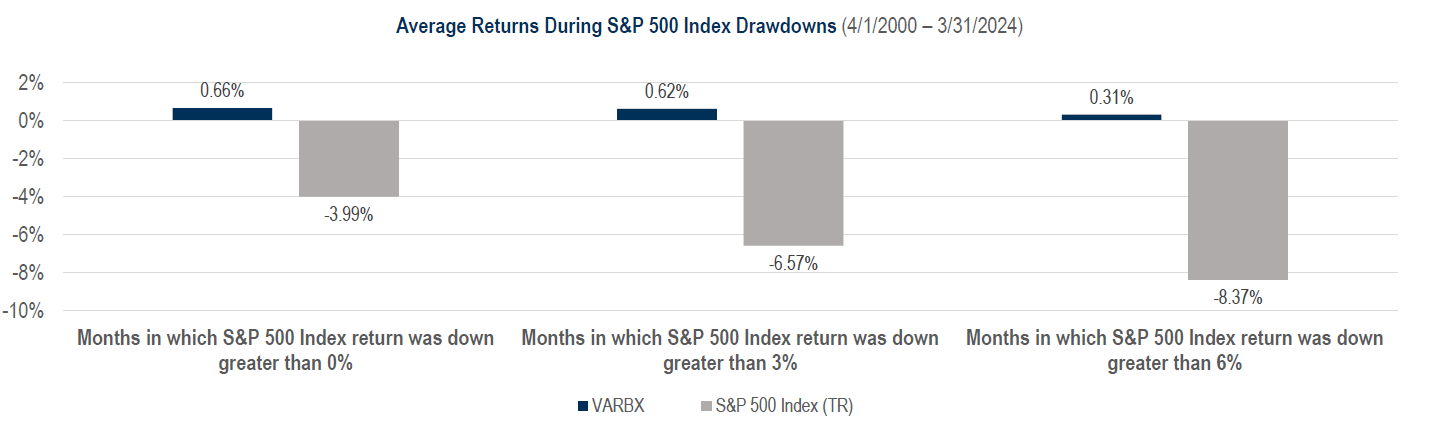

Downside mitigation & stable volatility profile

- Seeking to provide potential relief from market fluctuations is a key feature of merger arbitrage, as the strategy has historically exhibited lower volatility than the stock market, and has an uncorrelated return profile to both stocks and bonds providing diversification benefits to portfolios.

Greater embedded return potential in rising interest rate environments

- The Fund’s strategy is built to outperform in rising rate environments because arbitrage spreads are positively correlated to interest rates.

- The arbitrage spread is determined by three building blocks: (1) duration/timing to close; (2) deal risk; and (3) the risk-free rate.

- As the risk-free rate increases, arbitrage spreads typically reset higher.

Highlights

VARBX 24+ Year Track Record (as of 3/31/24)1

- 8.82% Annualized Return Since Inception

- 1.50 Sharpe Ratio

- No down years

- -6.81% maximum drawdown

Portfolio

VARBX Metrics & Objectives

Attractive Return Potential

In “A-Grade” Merger Deal Spreads, the Historic Return Potential = +6-8%^

Low Volatility

Historically only 31% in overall volatility of the broad equity market

No Interest Rate Sensitivity

Merger spreads typically expand in rising rate environments

Low Beta

Historically < 0.2 to U.S. stocks and bonds

Low Leverage

Max 33% fund-level leverage

Minimize Drawdown

Largest max drawdown was -6.81%

^Source: AlphaRank, GMO

Strategy Keynotes

Announced Deals

Announced transaction deal bias; no speculative or soft catalyst investing

Conviction

Portfolio typically comprises 15-25 positions, diversified by sector and industry

Regional Focus

Focus on U.S. and Canada; no foreign deals with increased macro or regulatory risk

Shorter Duration

Average portfolio duration of approximately 3-4 months

Portfolio Construction

Positions are sized based on our judgement of the downside risk to the portfolio in the event of a deal break

Active Management

Analyze mergers for all risks, including antitrust, deal terms, financing & shareholder approval

Performance

VARBX Historical Net Returns (as of 3/31/24)

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | YTD | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2024 | 0.28% | 0.66% | 0.56% | 1.51% | |||||||||

| 2023 | 0.47% | 0.28% | -0.19% | 0.37% | -0.65% | 0.37% | 0.37% | 0.37% | 0.55% | 0.46% | 0.55% | 0.30% | 3.30% |

| 2022 | -0.09% | 0.38% | 0.47% | -0.19% | -0.66% | -0.19% | 0.48% | 0.38% | 0.09% | 0.75% | 0.65% | 0.41% | 2.50% |

| 2021 | 3.23% | 1.07% | -1.24% | 0.63% | -0.27% | 0.54% | 0.35% | 0.09% | 0.35% | 0.35% | 0.18% | 0.07% | 5.43% |

| 2020 | 0.19% | -0.28% | -2.10% | 0.97% | 0.10% | 0.10% | 0.10% | 0.19% | 0.48% | -0.38% | 1.72% | 2.92% | 4.00% |

| 2019 | 0.66% | 0.19% | 0.09% | 1.02% | -0.28% | -0.18% | 1.02% | 0.27% | 0.27% | -0.27% | 0.45% | 0.40% | 4.27% |

| 2018 | 0.48% | 0.67% | -1.89% | -2.22% | 1.78% | 1.65% | 0.00% | 0.67% | 0.66% | -0.85% | 2.56% | 0.64% | 4.11% |

| 2017 | -0.77% | 0.49% | 0.87% | 0.29% | 0.76% | 0.66% | 0.38% | 0.33% | 0.09% | 0.28% | -1.40% | 0.36% | 2.39% |

| 2016 | 0.00% | 0.88% | 1.46% | -0.38% | 0.87% | 0.00% | -0.76% | -1.15% | 0.10% | 0.10% | 0.29% | 0.35% | 1.73% |

| 2015* | 0.80% | 1.04% | 0.35% | 0.46% | 0.48% | -2.12% | 1.74% | 0.49% | -0.14% | 0.02%^ | 0.60% | 1.43% | 5.22% |

| 2014 | 0.08% | 0.31% | 0.25% | -3.89% | 1.94% | 1.30% | 2.66% | 1.81% | -0.51% | -1.08% | 2.03% | -0.02% | 4.81% |

| 2013 | 0.33% | 0.29% | 0.74% | 0.18% | 0.11% | 0.15% | 0.69% | 0.18% | 0.86% | 0.80% | 0.31% | 0.78% | 5.55% |

| 2012 | 0.44% | 0.24% | 0.30% | 0.17% | 0.24% | 0.43% | 0.09% | 0.44% | 0.13% | -3.37% | 1.62% | 1.69% | 2.36% |

| 2011 | 0.45% | 0.61% | 0.03% | 0.32% | 0.55% | 0.49% | 0.20% | -0.24% | -0.20% | 0.75% | 0.05% | -0.02% | 3.03% |

| 2010 | 0.29% | 0.96% | 1.41% | 0.41% | 0.02% | 0.26% | 0.60% | 2.32% | 0.18% | 0.19% | 0.22% | 0.26% | 7.33% |

| 2009 | 0.31% | 0.24% | 0.69% | 0.40% | 0.02% | 1.34% | 1.90% | 1.24% | 0.70% | 0.73% | 1.35% | 0.68% | 10.02% |

| 2008 | -0.14% | 0.79% | 1.16% | 2.00% | 1.55% | 0.32% | 1.20% | 2.62% | 1.05% | 1.72% | 0.24% | 0.59% | 13.88% |

| 2007 | 3.54% | 0.81% | 0.84% | 0.94% | 2.14% | -0.29% | 2.48% | 2.52% | 0.66% | 1.72% | 2.06% | 1.40% | 20.46% |

| 2006 | 3.90% | 1.61% | 1.11% | 0.82% | 0.16% | 1.96% | 0.73% | -0.23% | 1.39% | 2.41% | 2.36% | 1.02% | 18.58% |

| 2005 | 0.50% | 1.12% | 1.48% | -0.45% | 2.10% | 0.66% | 1.80% | 1.00% | 0.57% | 0.30% | 1.74% | 2.38% | 13.99% |

| 2004 | 1.17% | 1.17% | 2.11% | 0.78% | 1.16% | 1.05% | -1.10% | 0.01% | -3.82% | 1.50% | 1.00% | 1.87% | 6.97% |

| 2003 | 0.58% | 0.58% | 0.35% | 1.19% | 0.01% | 0.16% | 0.29% | -0.03% | 1.11% | 1.17% | 0.58% | 1.75% | 8.00% |

| 2002 | 0.21% | 0.51% | 1.00% | 0.02% | 1.14% | 0.93% | 0.23% | 0.33% | 0.84% | 0.01% | 0.21% | 0.49% | 6.07% |

| 2001 | 2.68% | 1.75% | -5.20% | -1.70% | 3.80% | 1.40% | 0.82% | 2.68% | 1.75% | 1.17% | 1.40% | 2.52% | 13.52% |

| 2000 | ---- | ---- | ---- | 1.30% | 4.97% | 7.70% | 6.30% | 1.28% | 9.92% | 3.85% | 3.97% | 4.20% | 52.48% |

Source: UMB Bank

*On October 1, 2015, the Fund was converted from a Limited Partnership to 1940 Act Registered Fund.

Class I Shares Risk Metrics (4/1/2000- 3/31/2024)

Correlation

| VARBX | BB Agg | S&P 500 | |

|---|---|---|---|

| VARBX | 1.00 | 0.11 | 0.04 |

| BB Agg | 1.00 | 0.11 | |

| S&P 500 | 1.00 |

Beta

| VARBX | BB Agg | S&P 500 | |

|---|---|---|---|

| VARBX | 1.00 | 0.12 | 0.01 |

| BB Agg | 1.00 | 0.03 | |

| S&P 500 | 1.00 |

Monthly Standardized Performance (%) as of 3/31/20241

| Net Asset Value (NAV)** | QTD | YTD | 1 Year | 3 Year | 5 Year | 10 Year | Since Fund Inception |

|---|---|---|---|---|---|---|---|

| VARBX – Class I Shares | 1.51 | 1.51 | 4.27 | 3.22 | 4.01 | 3.86 | 8.82 |

| VARAX – Class A Shares | 1.44 | 1.44 | 3.85 | 2.88 | 3.66 | 3.53 | 8.51 |

| VARCX – Class C Shares | 1.13 | 1.13 | 3.05 | 2.08 | 2.88 | 2.74 | 7.65 |

| Index Performance*** | |||||||

| Bloomberg U.S. Aggregate Bond Index | -0.78 | -0.78 | 1.70 | -2.46 | 0.36 | 1.54 | 3.92 |

| S&P 500 Index | 10.56 | 10.56 | 29.88 | 11.49 | 15.05 | 12.96 | 7.38 |

Quarterly Standardized Performance (%) as of 3/31/20241

| Net Asset Value (NAV)** | QTD | YTD | 1 Year | 3 Year | 5 Year | 10 Year | Since Fund Inception |

|---|---|---|---|---|---|---|---|

| VARBX – Class I Shares | 1.51 | 1.51 | 4.27 | 3.22 | 4.01 | 3.86 | 8.82 |

| VARAX – Class A Shares | 1.44 | 1.44 | 3.85 | 2.88 | 3.66 | 3.53 | 8.51 |

| VARCX – Class C Shares | 1.13 | 1.13 | 3.05 | 2.08 | 2.88 | 2.74 | 7.65 |

| Index Performance*** | |||||||

| Bloomberg U.S. Aggregate Bond Index | -0.78 | -0.78 | 1.70 | -2.46 | 0.36 | 1.54 | 3.92 |

| S&P 500 Index | 10.56 | 10.56 | 29.88 | 11.49 | 15.05 | 12.96 | 7.38 |

Source: UMB Bank

| Ticker | Record Date | Ex-Dividend Date | Payment Date | Income Div | ST Capital | LT Capital |

|---|---|---|---|---|---|---|

| VARBX | 12/4/2023 | 12/5/2023 | 12/5/2023 | 0.36548 | 0.06677 | - |

| VARBX | 12/2/2022 | 12/5/2022 | 12/5/2022 | 0.01272 | 0.05000 | 0.03063 |

| VARBX | 12/3/2021 | 12/6/2021 | 12/6/2021 | 0.30394 | 0.57827 | 0.00509 |

| VARBX | 12/2/2020 | 12/3/2020 | 12/3/2020 | - | 0.08734 | 0.00049 |

| VARBX | 12/2/2019 | 12/3/2019 | 12/3/2019 | - | 0.58251 | - |

| VARBX | 12/26/2018 | 12/27/2018 | 12/27/2018 | 0.13230 | 0.05889 | 0.03756 |

| VARBX | 12/20/2017 | 12/21/2017 | 12/21/2017 | - | 0.17784 | - |

| VARBX | 12/20/2016 | 12/21/2016 | 12/21/2016 | - | 0.00615 | 0.00001 |

| VARBX | 12/4/2015 | 12/7/2015 | 12/7/2015 | - | 0.00422 | - |

Performance data quoted represents past performance. Past performance is not a guarantee of future results and current performance may be higher or lower than performance quoted. Investment returns and principal value will fluctuate and shares when sold or redeemed, may be worth more or less than their original cost. Returns are average annualized total returns, except those for periods of less than one year, which are cumulative.

1The Fund commenced operations as a registered investment company under the Investment Company Act of 1940 (“1940 Act”) on October 1, 2015 after the reorganization and transfer of substantially all assets of the Highland Capital Management Institutional Fund, LLC, a Delaware limited liability company (the “Predecessor Fund”) into the Fund. The Predecessor Fund commenced operations on April 1, 2000 and was a private fund not subject to certain restrictions imposed by the 1940 Act or the Internal Revenue Code of 1986, as amended, on regulated investment companies. The Fund’s objectives, policies, guidelines and restrictions are, in all material respects, substantially the same as those of the Predecessor Fund. For the period of April 1, 2000 to September 30, 2015, the Fund’s performance table above reflects the performance of the Predecessor Fund, which was managed by Glenfinnen Capital, L.L.C. until Vivaldi Capital Management, LLC took over as investment advisor to the Predecessor Fund in July 2015.

2The distribution history represents dividends that were paid by the Fund and is not a guarantee of the Fund’s future dividend-paying ability. Dividend and capital gains distributions generally will be reinvested in additional common shares of the Fund unless a shareholder elects in writing to receive distributions in cash.

**NAV Returns represent the Fund’s net assets (assets less liabilities) divided by the Fund’s outstanding shares. The Fund’s performance reflects fee waivers and expense reimbursements, absent which performance would have been lower.

***Performance information for the indexes is for illustrative purposes only and does not represent actual fund performance. Indexes do not charge management fees or brokerage expenses, and no such fees or expenses were deducted from the performance shown. All Index returns assume that dividends are reinvested when they are received. Indexes are unmanaged and an investor cannot invest directly into an index.

VARBX Expense Ratio – Gross: 1.91% ; Net: 1.52%. VARAX Expense Ratio – Gross: 2.22% ; Net: 1.83%. First Trust Capital Management has agreed to waive fees and/or pay Fund expenses to prevent the annual net expense ratio from exceeding 1.55% and 1.85% of the average daily net assets of Class I Shares and Class A Shares, respectively, until 1/31/2024.

You should consider a fund’s investment objectives, risks, and charges and expenses carefully before investing. You can download a prospectus or summary prospectus, or contact First Trust Capital Management at 1-800-988-5196 to request a prospectus or summary prospectus which contains this and other information about a fund. The prospectus or summary prospectus should be read carefully before investing.

Risk Considerations

You could lose money by investing in a fund. An investment in a fund is not a deposit of a bank and is not insured or guaranteed. There can be no assurance that a fund’s objective(s) will be achieved. Please refer to each fund’s prospectus and Statement of Additional Information for additional details on a fund’s risks. The order of the below risk factors does not indicate the significance of any particular risk factor.

Current market conditions risk is the risk that a particular investment, or shares of the fund in general, may fall in value due to current market conditions. As a means to fight inflation, the Federal Reserve and certain foreign central banks have raised interest rates and expect to continue to do so, and the Federal Reserve has announced that it intends to reverse previously implemented quantitative easing. Recent and potential future bank failures could result in disruption to the broader banking industry or markets generally and reduce confidence in financial institutions and the economy as a whole, which may also heighten market volatility and reduce liquidity. In February 2022, Russia invaded Ukraine which has caused and could continue to cause significant market disruptions and volatility within the markets in Russia, Europe, and the United States. The hostilities and sanctions resulting from those hostilities have and could continue to have a significant impact on certain fund investments as well as fund performance and liquidity. The COVID-19 global pandemic, or any future public health crisis, and the ensuing policies enacted by governments and central banks have caused and may continue to cause significant volatility and uncertainty in global financial markets, negatively impacting global growth prospects.

Market risk is the risk that a particular security, or shares of a fund in general may fall in value. Securities are subject to market fluctuations caused by such factors as general economic conditions, political events, regulatory or market developments, changes in interest rates and perceived trends in securities prices. Shares of a fund could decline in value or underperform other investments as a result. In addition, local, regional or global events such as war, acts of terrorism, spread of infectious disease or other public health issues, recessions, natural disasters or other events could have significant negative impact on a fund.

In managing a fund’s investment portfolio, the portfolio managers will apply investment techniques and risk analyses that may not have the desired result.

Investments in companies that are the subject of a publicly announced transaction carry the risk the transaction is renegotiated, takes longer to complete than originally planned and that the transaction is never completed. Any such event could cause a fund to incur a loss. The risk/reward payout of merger arbitrage strategies typically is asymmetric, with the losses in failed transactions often far exceeding the gains in successful transactions.

An investment in SPACs, which are typically traded in the over-the-counter market, may also have little or no liquidity and may be subject to restrictions on resale.

Any decrease in negative correlation or increase in positive correlation between hedging positions the Advisor anticipated would be offsetting (such as short and long positions in securities or currencies held by the Fund) could result in significant losses for the Fund.

Leverage may result in losses that exceed the amount originally invested and may accelerate the rates of losses.

Short selling creates special risks which could result in increased gains or losses and volatility of returns. Because losses on short sales arise from increases in the value of the security sold short, such losses are theoretically unlimited.

The use of derivatives, including options, can lead to losses because of adverse movements in the price or value of the underlying asset, index or rate, which may be magnified by certain features of the derivatives.

The Fund must segregate liquid assets or engage in other measures to “cover” open positions with respect to certain kinds of derivatives and short sales.

Certain fund investments may be subject to restrictions on resale, trade over-the-counter or in limited volume, or lack an active trading market. Illiquid securities may trade at a discount and may be subject to wide fluctuations in market value.

High portfolio turnover may result in higher levels of transaction costs and may generate greater tax liabilities for shareholders.

The prices of fixed income securities respond to economic developments, particularly interest rate changes, changes to an issuer’s credit rating or market perceptions about the creditworthiness of an issuer.

There is no guarantee that a fund will provide a fixed or stable level of distributions at any time or over any period of time.

High yield securities, or “junk” bonds, are less liquid and are subject to greater market fluctuations and risk of loss than securities with higher ratings, and therefore, are considered to be highly speculative.

Preferred securities combine some of the characteristics of both common stocks and bonds. Preferred stocks are typically subordinated to other debt instruments in terms of priority to corporate income, and therefore will be subject to greater credit risk than those debt instruments.

Securities of micro-, small- and mid-capitalization companies may be more vulnerable to adverse general market or economic developments, may be less liquid, and may experience greater price volatility than larger, more established companies.

Securities of non-U.S. issuers are subject to additional risks, including currency fluctuations, political risks, withholding, the lack of adequate financial information, and exchange control restrictions impacting non-U.S. issuers.

A fund is susceptible to operational risks through breaches in cyber security. Such events could cause a fund to incur regulatory penalties, reputational damage, additional compliance costs associated with corrective measures and/or financial loss.

Changes in currency exchange rates and the relative value of non-US currencies may affect the value of a fund’s investments and the value of a fund’s shares.

First Trust Capital Management L.P. (FTCM) is the adviser to the Fund. The Fund’s distributor is FTCM’s affiliate, First Trust Portfolios L.P.

The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

Definitions:

Bloomberg U.S. Aggregate Bond Index- The Index covers the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS, ABS, and CMBS.

S&P 500 Index- The Index is an unmanaged index of 500 companies used to measure large-cap U.S. stock market performance.

Correlation- is a measure of the similarity of performance.

Beta- is a measure of price variability relative to the market.

Standard Deviation- is a measure of price variability (risk).

Sharpe Ratio- is a measure of excess reward per unit of volatility. Correlation is a measure of the similarity of performance.

Spread- is the difference in price between the current trading price of the company being acquired (“target company” or “target”) following the announcement of the merger and the contractual price to be paid for the target company when the transaction closes.

Max Drawdown- is the peak to trough decline during a specific record period of an investment or fund. It is usually quoted as the percentage between the peak to the trough.