We are all going to need SpaceX. But SpaceX at a price that we can afford!

The best “access point” for purchasing private shares of SpaceX is through the company-run employee tender. This tender occurs on a rolling ~6-month basis. The biannual tender is typically oversubscribed with participation from all the top venture capital firms and institutional allocators vying for capacity and shares.

We continue to receive programmatic access to the SpaceX tender. As noted, these company-run tenders are generally the best pricing available to investors.

In December 2023, SpaceX completed its tender in January at $97 per-share, imputing a $180bn valuation.

Note: this transaction officially cemented SpaceX as the second most valuable private company in the world.

We have participated in previous tenders as well. SpaceX’s August 2023 tender was done at $150bn valuation, and the January 2023 tender was done at $137bn valuation.

Assuming the subsequent tenders are executed at higher prices, it does provide a nice (unrealized) markup for pre-existing investors.

For comparison, we have observed secondary transactions for SpaceX SPVs at ~$104-105 per-share, a 7-10% premium to the aforementioned company-run tenders. Also, the SPVs will have various fee arrangements and operating expense schedules that purchasing investors should be wary of. We prefer to avoid these SPV transactions – unless we can get extremely comfortable from an operational due diligence standpoint.

It is not often we say that we are proud to merely have access to an investment opportunity. But if anything, the company-run SpaceX tenders fall into that category for us and our LPs.

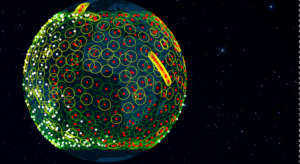

Starlink Coverage Map